By Laurence B. Mussio

Note: This excerpt from Laurence B. Mussio’s Whom Fortune Favours, published earlier this year by McGill-Queen’s University Press, introduces Horatio Gates – one of Bank of Montreal’s early founders. Dr. Mussio’s two-volume history of Bank of Montreal, a boxed set with 100 color photos (available in English and French), provides a fascinating glimpse into North American history through one of Canada’s most enduring institutions. Founded in 1817, 50 years before Canadian Independence, Bank of Montreal played a key role in the development of the city and country (such as providing funding for crucial infrastructure projects of the 19th century – the CPR Bridge and Lachine Canal in the 1820s, the Magnetic Telegraph Company in the 1860s and the Canadian Pacific Railway in the 1880s) and establishing Montreal as a major player on the international stage. As Niall Ferguson writes in the Foreword, “History does indeed matter – and Canadian financial history turns out to matter a good deal more than most people suppose. It is in this spirit that Laurence B. Mussio has written this exemplary history.”

CEO emeritus William A. Downe will join Laurence B. Mussio for the virtual launch event for Whom Fortune Favours next Tuesday, July 7 at 12:00pm EDT, in Zoom webinar format. Register here and receive a discount code to purchase the book directly from the publisher.

Horatio Gates is another founder whose career, relationships, and connections exemplify the kind of reputational capital so crucial for the success of the Bank of Montreal project. Gates was an American by birth (born in Barre, Massachusetts in 1777) who, by his early twenties, had become involved in the marketing of agricultural products from Vermont and New York to Montreal and the St Lawrence valley. In 1807 he moved to Montreal and established a store with Abel Bellows, a fellow American, on St Paul Street. The War of 1812 provided Gates with an opportunity to connect the sudden spike in British military demand for provisions in the Canadas with American supply in meat and produce. His American connections and Canadian clients in a time of war required nimble diplomacy and reliable intelligence on both sides of the border. Gates was ready to sell his holdings and leave Lower Canada should the circumstances warrant it. He reluctantly took the oath of allegiance but obtained an exemption from taking up arms against his home country.

Gates’s business interests flourished in the aftermath of the war, as he became a major supplier of provisions to Lower Canadian garrisons below Quebec. He engaged in multiple business partnerships, from provisioning to the importation of British and American finished goods, to the exportation of potash, wheat, flour, pork, and staves. In this extensive range of business activity, Gates developed an impressive network of contacts through which passed hundreds of transactions involving bank notes, cash, and bills of exchange. As the Lower Canadian economy moved away from the fur trade and toward participation in a more diversified, continental, and transatlantic economy, payments, transactions, and matters of credit became increasingly urgent matters. Gates’s sophisticated grasp of the need for financial intermediation was only part of the story, however. He also understood the relationship between credit and information flows about commercial, trade, and general conditions affecting business. His biographer notes that he published correspondence and circulars on the subject of Canadian trade in the United States, especially on prices, crops, and inventories, as well as vital credit information.

The contribution of Horatio Gates to the establishment of the Bank of Montreal was indispensable. As a prominent Montreal merchant with continental networks, as an agent for the New York bank of Prime, Ward and Sands, and as the founder most able to access American capital and shareholders for the venture, he played a key strategic role. His deep involvement in the first decade of the bank’s activities underscores his conviction that properly functioning, effective banking institutions would be vital for the future prosperity of the colony. Indeed, he was so convinced that he also participated in the foundation of the Bank of Canada, a bank established to specialize with the United States trade in 1822 and which was merged with the Bank of Montreal in 1831.

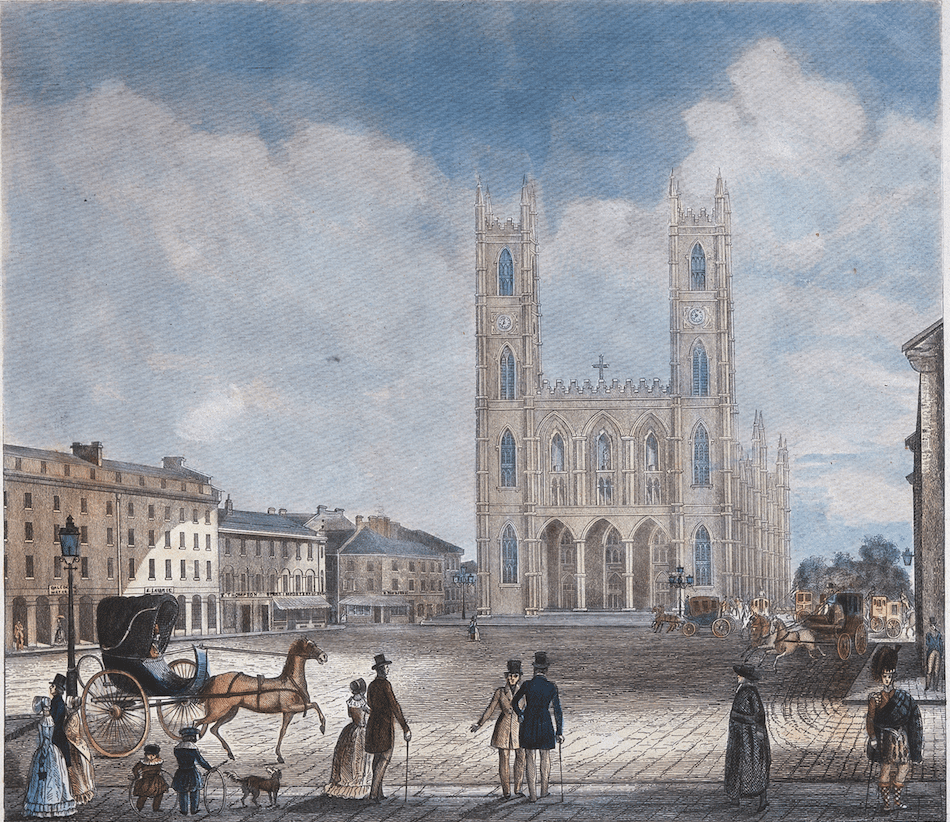

Gates’s social standing in Montreal, his cultural and philanthropic commitments, and his active participation in church affairs placed him among the leading citizens in the city. At the same time, his conciliatory disposition allowed him to serve as a bridge between his fellow Montreal merchants and the Parti Canadien. As Jean-Claude Robert notes, Gates’s career closely parallels and intersects with Montreal’s rise as a metropolis in the first three decades of the nineteenth century. Starting from a position of economic weakness, the city was able to become, thanks to the efforts of its middle class, the pre-eminent economic power in Lower Canada.

CEO emeritus William A. Downe will join Laurence B. Mussio for the virtual launch event for Whom Fortune Favours next Tuesday, July 7 at 12:00pm EDT, in Zoom webinar format. Register here and receive a discount code to purchase the book directly from the publisher.

Laurence B. Mussio is a senior Canadian business historian, special advisor to senior executives of North American financial institutions and public commentator. He has taught in the undergraduate and graduate faculties at several Canadian and American universities. Dr. Mussio is also CEO of SIERC — a Toronto, Canada based consultancy specializing in mobilizing context for decision-making. Dr. Mussio is also a co-founder of the Long-Run Initiative (LRI), an international not-for-profit forum for academic experts, business leaders and public policymakers applying insight from hindsight to contemporary grand challenges.

Laurence B. Mussio is a senior Canadian business historian, special advisor to senior executives of North American financial institutions and public commentator. He has taught in the undergraduate and graduate faculties at several Canadian and American universities. Dr. Mussio is also CEO of SIERC — a Toronto, Canada based consultancy specializing in mobilizing context for decision-making. Dr. Mussio is also a co-founder of the Long-Run Initiative (LRI), an international not-for-profit forum for academic experts, business leaders and public policymakers applying insight from hindsight to contemporary grand challenges.